Cloudera Looks Ready To Continue Climbing - Cloudera Inc (Pending:CLDR) | Seeking Alpha

Overview

The 25-day quiet period on Cloudera Inc. (NYSE: CLDR[1]) is set to expire on May 23, allowing the firm's IPO underwriters to publish detailed positive reports and recommendations on the company.

Cloudera operates a data management, analytics software, and machine learning platform in the United States, Europe, and Asia.

Underwriters (Allen & Co., J.P. Morgan Securities, Morgan Stanley, BofA Merrill Lynch, Citigroup Global Markets, Deutsche Bank Securities, JMP Securities, Raymond James & Associates, and Stifel Nicolaus & Company) have been restricted from publishing research reports on Cloudera since the company's IPO on 4/27; we predict the strong syndicate will be eager to release positive reports and recommendations once restrictions are lifted.

We also expect this event to lead to a boost in the stock price for Cloudera (according to our research[2]). Investors who purchase shares prior to the 5/23 expiration date could benefit from a full ramp up in price over a multi-day period.

Business Overview

Based in Palo Alto, and founded in 2008, Cloudera's platform offers an integrated suite of capabilities that includes machine learning, data management, and advanced analytics. The objective of its platform is to break down and make sense of large data. Its open-source platform Hadoop provides a scalable, agile, and cost-effective solution for enterprises and is currently being used by 8 percent of the global 8,000 companies in the cloud.

The company has a strong third-party partner ecosystem with over 2,500 systems integrators, resellers, independent software vendors, and cloud and platform providers, all of which register in the Cloudera Connect partner program giving them access to a variety of resources. Cloudera has a strategic partnership with Intel Corporation (NASDAQ:INTC[3]) to optimize Cloudera software with Intel processors. Due to this partnership, the Cloudera platform achieves a differentiated performance across Intel architecture, and this is expected to continue with future Intel technology.

In fiscal 2017, approximately 30% of subscription revenue came from clients who generated over $1M in revenue. Approximately 54% of subscription revenue came from clients that generated between $500,000 and $1,000,000 in subscriptions sales.

Management

CEO and Director Thomas Reilly[5] has served in this position since 2015. His previous experience comes from senior positions at HP Enterprise Security Products, Hewlett Packard, ArcSight, IBM, and BroadQuest. Reilly holds a BS in Mechanical Engineering from the University of California, Berkeley.

CFO James Frankola[6] has served in his position since 2012. He has over 25 years of financial and operational leadership positions with international technology companies. These include Yodlee, Ariba Inc., Procurin, Avery Dennison, and IBM Storage Systems. Frankola holds a Bachelor of Science degree in Accounting from Pennsylvania State University and a Master of Business Administration in Finance from New York University.

Early Market Performance

Cloudera made its debut on 4/27, raising $225M through the offer of 15 million shares. Shares were priced at $15, the higher end of its expected price range of $12 to $14 and then continued to move up throughout the day. Cloudera finished its first day of trading at $18, a 20% increase. It reached a high of $21.74 on May 4 and dropped back to $19.56 on May 8. The stock currently trades at $20.01 (close 5/19).

Financial Highlights

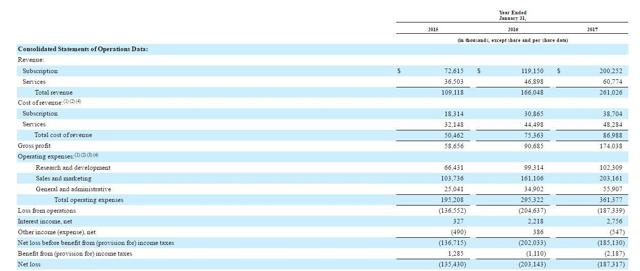

Cloudera has shown highly impressive revenue growth; revenue grew to $261.03 million in 2017 from $166.05 million in 2016. At the same time, gross margins have been steadily improving and are above average for the industry. Gross profit grew to $174.04 million in 2017 from $90.69 million in 2016. The company has not yet generated a profit. Net loss decreased to ($187.32) million in 2017 from ($203.14) million in 2016.

As of its IPO, the company had cash and cash equivalents of $235 million and total liabilities of $199 million.

Our Firm's Prior Analysis

We previewed Cloudera ahead of its IPO on our IPO Insights Platform[8].

At the time, we recommended investors hold off on purchasing shares as we had concerns about its relatively high cash burn and ability to generate profits in the future. Although these are still concerns, Cloudera has performed well since making its debut, and we expect the capital injection from its IPO will enable it to continue growing as it works towards profitability.

The company has shown impressive growth in revenue and customer base, as well as improving gross margins. It still needs to show it can operate profitably; however, Cloudera appears on track to continue growing and showing operational improvements.

Conclusion: New Buying Opportunity Ahead of Event

Our firm has found strong price movement[9] around quiet period expiration events for companies which have performed well since their IPO, were highly followed deals, and which are backed by a strong team of underwriters. Cloudera fits the criteria for all three.

The stock is up nearly 40% from its IPO price, and we predict it has further room to climb after restrictions are lifted on 5/23.

We recommend investors consider purchasing shares ahead of the 5/23 date to take full advantage of impending inclines.

Don Dion's IPO Insights provides up-to-date information and analysis on the major IPOs each week, along with additional opportunities to invest and short these stocks at their quiet period and lockup period expirations, respectively. Consider following us at the link above. We will continue our PRO offerings on Seeking Alpha alongside our more exclusive research.[10]

Disclosure: I am/we are long CLDR.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

References

- ^ Cloudera Inc (seekingalpha.com)

- ^ research (seekingalpha.com)

- ^ Intel Corporation (seekingalpha.com)

- ^ Company Website (www.cloudera.com)

- ^ Thomas Reilly (www.sec.gov)

- ^ James Frankola (www.sec.gov)

- ^ S-1/A (www.sec.gov)

- ^ IPO Insights Platform (seekingalpha.com)

- ^ strong price movement (seekingalpha.com)

- ^ IPO Insights (seekingalpha.com)

Comments